Thomas González: Why selling art does not make sense

Source: Thomas González Art Loans

Art was seen as an exotic investment in the past. Art is something we cannot measure like a stock or gold. The artistic value of a Warhol is not measurable with numbers.

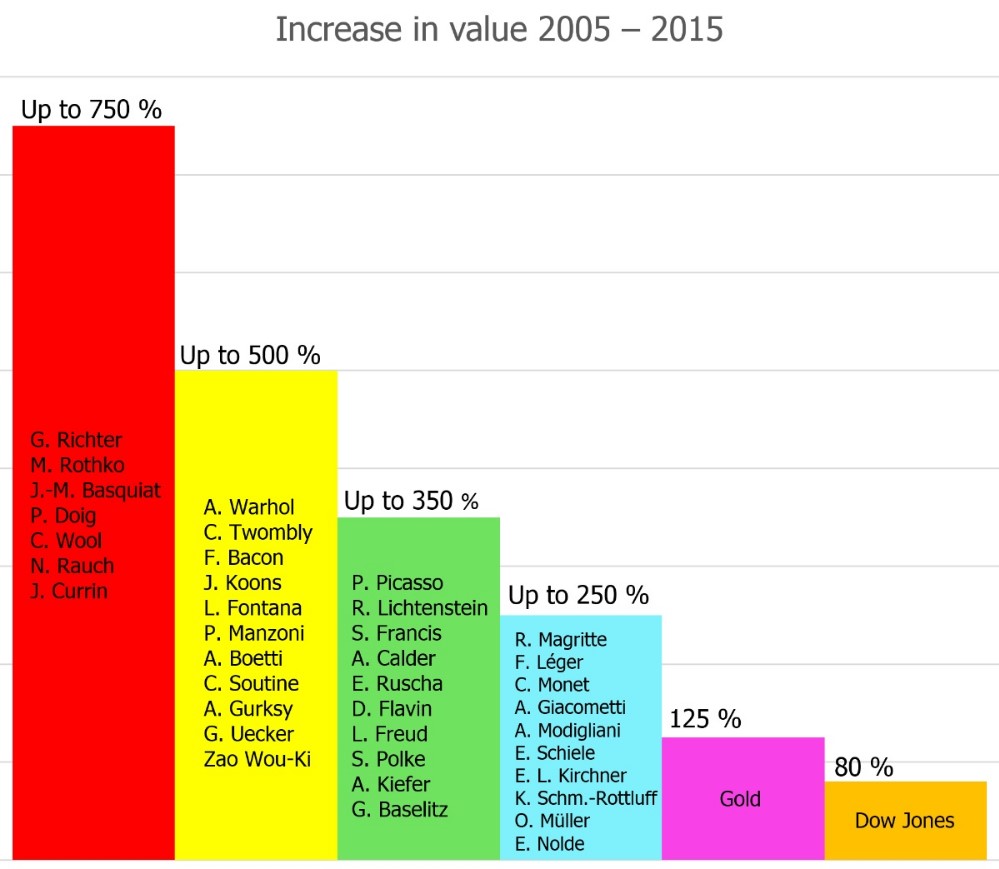

Now if we take a look at the numbers of the auction results of the past two years it becomes clear that art has been the best investment. Top works by artists like Richter, Basquiat, Doig and many many more went up up to 750 per cent in value in the past ten years. In the same period, the Dow Jones index went up just 80 per cent, similar to many other stock market indices. Gold did about 125 per cent.

Banks don’t pay any interest anymore, money and stock markets are unstable nowadays. It has become possible that major banks and even whole European countries crash.

Banks don’t pay any interest anymore, money and stock markets are unstable nowadays. It has become possible that major banks and even whole European countries crash.

Art is much safer as it was seen before. As a conclusion, it does not make sense to sell good art positions. If you need liquidity, rather benefit from an art loan and cash out part of the profit you already did with your collection. If you bought a good Richter, Warhol or Twombly or even a Kippenberger five years ago, your profit today would be between 200 per cent and 300 per cent. An art loan costs you around 9 per cent each year and you can profit from a flexible credit line and the fact that your artworks are the only collateral (non recourse). On top, you avoid selling fees (average 20 per cent) and tax payments on your sale profit.

Thomas González Art Loans

Phone: +49 (0) 30 2062 55 31

Email