New insurance solutions from Willis will cover digital art and ease use of art as collateral

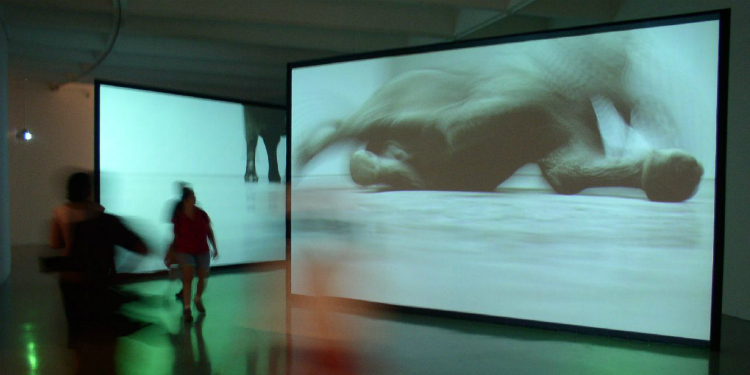

Video Installation at Hishhorn Museum DC, Photo Courtesy of Tim Hill.

New developments from insurance broker Willis will soon make it possible to insure art made in contemporary media such as video, says Richard Nicholson, executive director in Willis’s Fine Art, Jewellery and Specie practice.

He predicts that in 2015 there will be a surge in this type of coverage as fine art insurers seek to close the gap that has opened up between the fast moving art world and the world of insurance.

“The art world seems to be leaving the specialist art insurance world behind when it comes to the artworks being produced by modern day artists using modern day technology,” he said.

“The art insurance world is trying to get its mind around questions such as: if a piece of artwork is hacked into and copied, then how does this impact a collector who has spent £500,000 on that video installation for his home? If somebody hacked into that object and “stole” it, then the value of that work would diminish significantly but there is no coverage for that at the moment as most, if not all art policies have a Cyber Attack Exclusion Clause.

“It’s a question of persuading the art insurers that if somebody hacks into a video installation to steal it or copy it, that is theft. It may be copyright theft but at the end of the day it’s theft. If somebody physically stole an ordinary piece of artwork the insurer would respond, so why don’t they amend the “physical” loss or damage aspect to include works made using modern technology such as video?”

He said that this is precisely why Willis is working on putting together a solution that will provide coverage for artworks of that type.

Also in the pipeline is coverage that will ease the process of raising capital by using items in your art collection as collateral.

“I have always felt that if we could provide the financial institutions with a safety net against the volatility and uncertainty of values in the art world, they would be able to lend more to those who wish to use their art collections to raise capital for whatever venture they want to enter into,” he said.

“We are looking at combining all the risks that a lending institution would face if they used or accepted art as collateral. These include coverage against risks such as authenticity, title, fidelity and residual value coverage – which means we make up the difference if they have to sell the assets they are holding as collateral and there is a shortfall between what they achieve from a sale and the amount of the loan due to any of the aforementioned risks.”

It is anticipated that the new collateralised art insurance facility will be launched during the first quarter of 2015.